On July 29th, Shanghai. There were still 3 minutes before 16:00. Kobayashi opened the Ele.me APP and added 3 cups of milk tea to the shopping cart in advance. At 16:00, Kobayashi submitted the order on time and waited nervously for the "gift" from Lucky Muse.

This is the "Guessing the answer and free order (that is, free order for 1 minute) " activity launched by Ele.me from June 21st (hereinafter referred to as the "free order activity"). The rules are: the platform publishes the question the day before, and the clue points to one or more groups of time. The next day, users have the opportunity to place an order within a specified minute. The upper limit of the free order amount in the early stage is 200 yuan, and the maximum is adjusted to 56 yuan in the later stage. So far, the activity has been held to the 5th issue, and has derived gameplay such as "whole network questions" "free order per minute" "double happy" "city special".

Kobayashi participated in the "city special". The day before, the number of votes in Shanghai exceeded Wuhan and thus won 80,000 free places, 10,000 in each game, a total of 8 games. In the end, Kobayashi became the lucky one of the more than 9,300th people to be exempted from the game. "Thrilling, fortunately I won the bet today".

Ele.me is a generous "treat", which is very eye-catching in the short term. How much bonus can it bring in the long run? It is also worth observing.

The form of free order is not new, and there are two reasons behind the high attention of the harvest.

Since its launch, Ele.me free-order activities have exploded in popularity, from "free-order answer" to "free-order time" to take turns on hot searches; as of August 2, #Ele.me free-order #topic has accumulated more than 3.70 billion reads on Weibo, and more than 50,000 notes on Xiaohongshu with the same keyword.

Source: Network

In fact, the form of free shopping is not uncommon. Dianping next door has played the set of "please eat" very well, VIP has the opportunity to be selected to eat "Overlord meal", and the corresponding only need to write "after eating"; many platforms and merchants will also solicit business with free shopping benefits on specific days.

Why is it that a form that is not novel can attract high attention? Market participants have explained to Hexun Finance that the free-order activity just happens to grasp the psychology of young people who love to pick up wool. If you guess the wrong answer, there is no loss. After all, three meals a day are rigid needs; if you guess correctly, it is the icing on the cake, why not do it? Therefore, many netizens joked that "betting on dogs will never give up" and "betting on nothing in the end".

In addition, the free-order activity is simpler and more crude than coupon return, collection and other preferential forms. As of June 30, the first phase of the activity has been free of charge for more than 956,000 orders. If calculated according to half of the maximum free-order 200 yuan in the period, Ele.me will pay nearly 10 million. After 5 periods, the number will be even larger.

The other side of the eye: from the title to the free order conditions have been complained

The development of free-order activities has not been smooth sailing, and Ele.me has also encountered user backlash in the topics, free-order conditions, and other links.

The title is usually a picture, covering elements such as guessing people’s names, chemical molecular formulas, traditional Chinese medicine, and music scores. Within two days of the event, the following beach beauty attracted controversy because all the number clues were invalid. The correct problem-solving pose is: The shape of the flowers is the root sign, and there are two people under the house, so the number in the root is 2. √ 2 is equal to 1.4142135623, and the ending number is June 23 of the day, so the free order time is 14:14 and 21:35 respectively.

This "bizarre" answer made users shout "You can play by yourself" "I’m really speechless, I’m going down". Some netizens said that they were not angry because the question was difficult, but because the question was illogical.

The free-order conditions are also full of controversy. For example, on July 17, Ele.me opened a "Black Diamond Special", and platform members had the opportunity to get free orders without answering questions. Facts have proved that the free benefits for members are not easy to get. On the Black Cat complaint, since July 18, netizens have participated in collective complaints one after another, saying that although they are Black Diamond members, they have not been free of orders in the special session.

Source: Black Cat Complaint

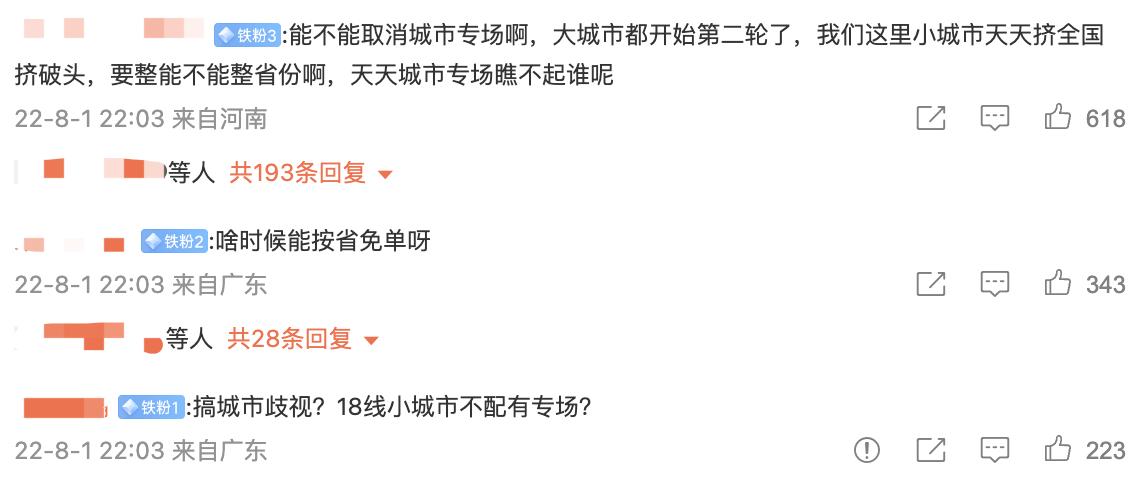

In addition, the "city special" has also been complained. In order to get more votes in the city, some people have fancy canvassing votes, and some people have questioned that the small city has no sense of participation, which once caused regional "scolding wars".

Source: Network

It is worth mentioning that in order to strengthen the food safety supervision of food delivery platforms, on July 21, the Market Supervision Bureau of Hangzhou City, Zhejiang Province interviewed the city’s Meituan, Ele.me and other food delivery platforms. One of the requirements is that "the catering industry should further standardize the business order, strictly prohibit vicious competition, and do not allow low-price dumping to disrupt the market order." This also makes the market full of worries: is it referring to the Ele.me free-order event? Can the free-order event continue?

However, on July 30, Ele.me announced that it would continue to hold its fifth edition from July 31 to August 7.

Thousands of investments benefit many parties, but the biggest winner is the platform

With praise and criticism, is this multi-million-dollar business still cost-effective? From the perspective of relevant parties, the free-order activity has benefited consumers, merchants and platforms.

"Nothing else, just hope you are happy", consumers did reap happy and free benefits. According to media reports, some people even ate 6 meals a day for picking wool.

For the food and beverage merchants who have been suffering from the epidemic for a long time, Zhou Di, a senior engineer of Fangrong Technology and a national science and technology expert of the Ministry of Science and Technology, told Hexun Finance, "The free-order activity has brought significant benefits, and consumers’ enthusiasm for participation is high. Many merchants have strong order growth and a significant recovery trend. Many merchants’like to mention ‘new daily peaks. The increasing order volume has injected business motivation into merchants and ignited consumption passion." Zhou Di also pointed out that the business growth brought by "free-order 1 minute" is "more than 1 minute": After the consumption peak at the beginning of the activity, the order volume still increased significantly for many consecutive days. The data shows that more than 300,000 merchants are involved in orders related to one phase of the activity alone.

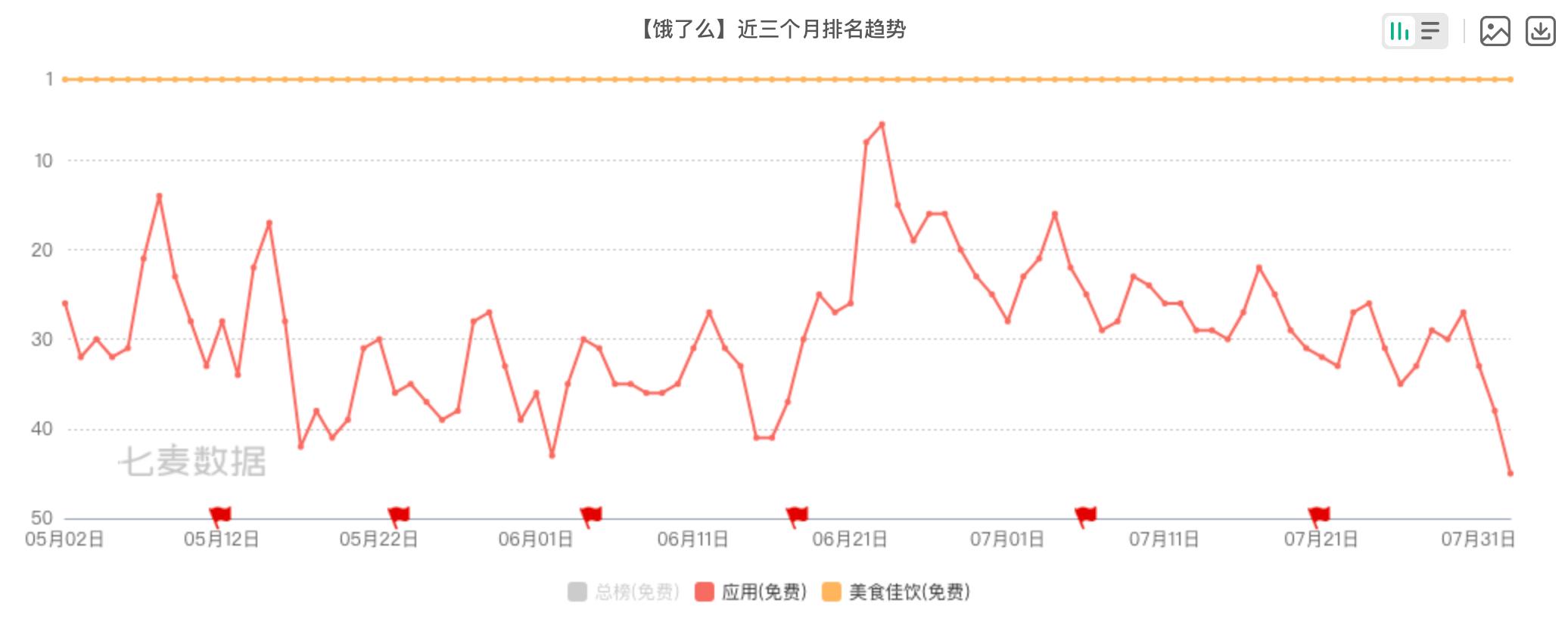

However, there is no free lunch in the world, and the biggest beneficiary is Ele.me. Seven data show that on June 21, the day of the official announcement of the free-order event, Ele.me APP jumped to the sixth place in the IOS free list, setting a new high in nearly three months.

Source: Qimai Data

Gao Zelong, a digital economy expert and expert consultant of MIIT’s Leading Talent Program, said that "this is a good public relations, publicity and marketing tool," and explained in detail, "On the one hand, Ele.me claims that the first phase of the event has been free of orders for more than 956,000 orders, which is nearly 1 million self-media communication. I believe that many users who are free of orders will send Moments. This communication effect is huge; on the other hand, the platform bears tens of millions of yuan in free orders, which is really nothing for a tech giant like Ele.me, not to mention that the cost of tens of millions of yuan may eventually be borne by merchants, not Ele.me itself. In any case, there is always a way for the platform to pass on these costs to the merchants; in the end, through such activities or events, it may also get media attention, which is even more cost-effective. "

Can free shopping save falling market share? Experts say "thousands of problems need to be solved"

The free-order activity is in full swing, and the platform anxiety behind it has also begun to surface.

At present, China’s takeaway market is still a "two-world" situation. After being "born" in 2008 and acquiring Baidu takeaway in August 2017, Ele.me’s market share once reached 54%, making it a well-deserved takeaway giant.

But starting in the second half of 2018, Ele.me was gradually overtaken by Meituan. In July 2020, its market share fell below 30%, and further fell to about 25% in the first half of 2021; in 2022, according to the 2022 Meituan and its industrial chain research report, Meituan’s market share in the takeaway field may approach 70%, its revenue is three times that of Ele.me, and it has an early advantage in the lower-tier market.

Although the two leaders have occupied more than 90% of the market share, there are still many rich and powerful players eyeing the position of the second child. In June, JD.com Retail CEO Xin Lijun confirmed in an interview that the company has considered entering the takeaway business; recently, Douyin has also begun to test the group buying home business. After users place an order in the catering live stream, they can ask the merchant to deliver it to their home. Earlier, SF Express incubated the group meal platform "Fengshi" in 2020.

Although there is no head-to-head confrontation, the future that can be met may usher in changes. Zhou Di pointed out that during this time, the economic operation has been greatly affected by the epidemic, and many catering companies have lost confidence in operating. At the same time, many Internet Tech Giants have flooded into the catering track. It has caused great pressure on Ele.me. In this case, Ele.me needs a mass traffic event to arouse everyone’s attention and re-raise the heat.

After Ele.me, JD.com and Meituan are also eager to try. The former launched the "Grab Free Orders, Not Alone" activity on July 28, in a format highly similar to "Free Orders for 1 Minute". Users have the opportunity to get free orders when they place an order at a specified time after guessing the puzzle; the latter started on July 31, and users place three orders randomly free of one order.

"This is reminiscent of Didi and Kuaidi’s online car-hailing subsidy war a few years ago. This kind of platform subsidy requires huge investment, but it is often very effective. It is an effective means to quickly acquire users and occupy the market," Gao Zelong told Hexun Finance.

"This is just one of the many factors for the success of the platform," Gao Zelong also said. What is the key to the long-term retention of users of the food delivery platform? In his opinion, whether it is Ele.me or JD.com, Meituan, to achieve ultimate success, it needs to solve thousands of problems, which is extremely difficult and complex.