When it comes to Tongzhou, the first thing that comes to mind is grain transportation. Beijing has always been known as a "city floating on the water", and Tongzhou has contributed a lot. Everyone is familiar with this history. But when it comes to the Republic of China, I’m afraid not many people know about Tongzhou’s contribution to Beijing’s public transportation.

In the early years of the Republic of China, something new in Beijing: the tram "clang" (the word "clang" is pronounced "DiangDiang" in old Beijing). The electricity it uses is specially provided by Tongzhou Power Plant. The author collects some old photos in an old photo album, which are images left by the owner of the photo album during his internship in Tongzhou Power Plant in the early 1940s. Through these old photos, the author learned more details.

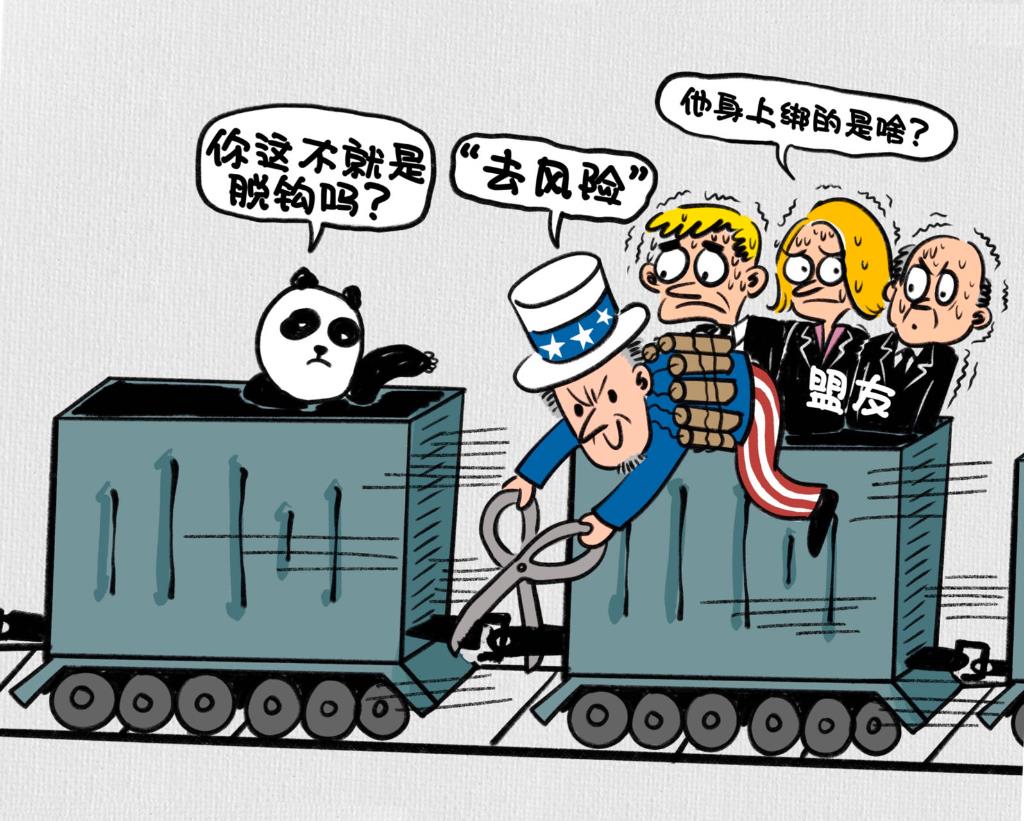

The exterior of Tongzhou Power Plant was shot in 1928, when the reservoir was rebuilt and the North Canal levee was reinforced.

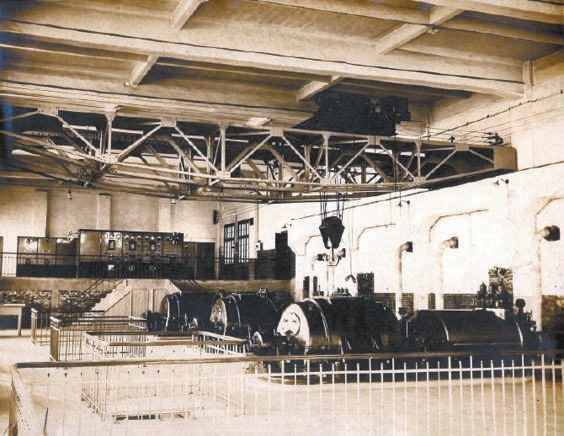

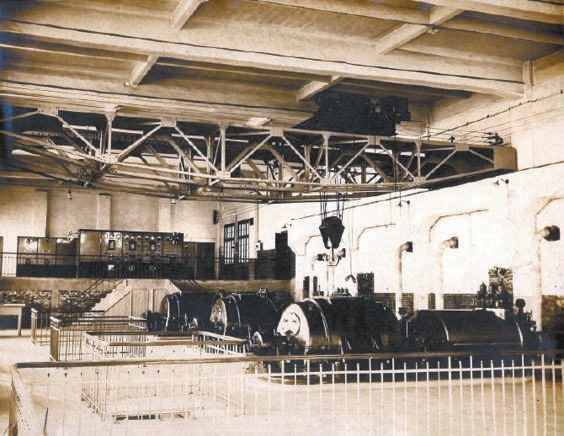

The generator set in Tongzhou Power Plant in 1928. When warlords scuffled, the war happened around the power plant site, so the construction period was delayed again and again.

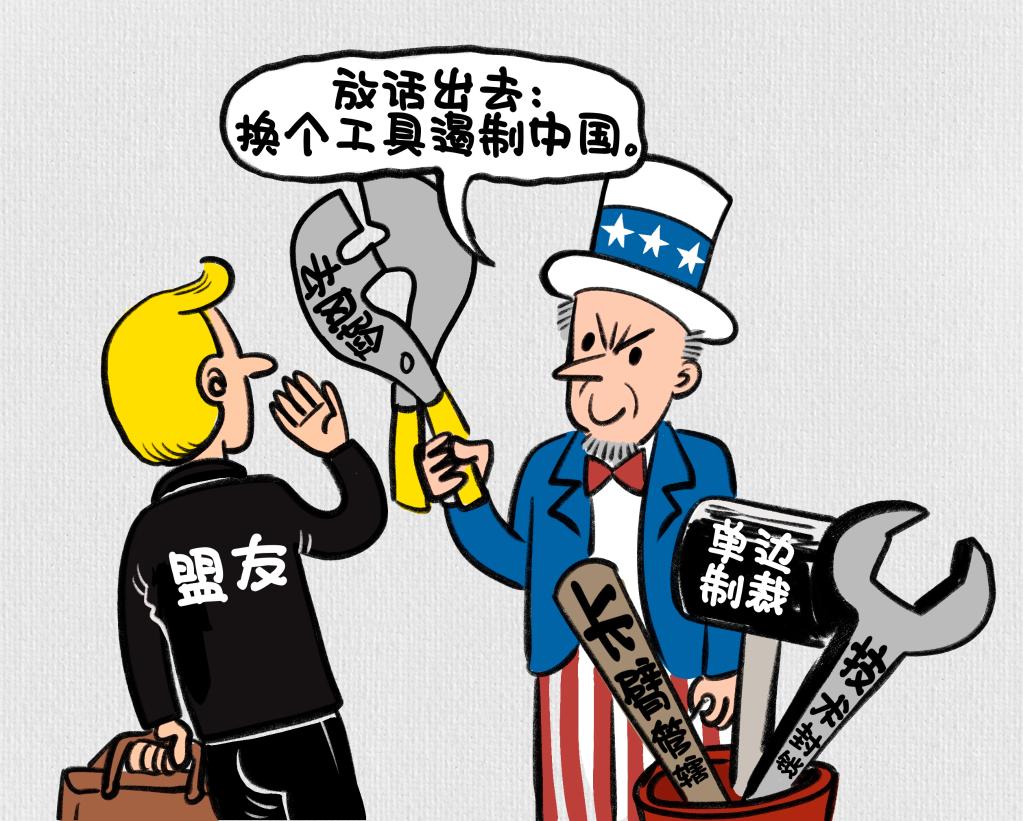

The old photo of the shed village, the big chimney in the upper right part is the symbol of Tongzhou Power Plant.

Power plant is a supporting project for trams.

In the 25th year of Guangxu (1899), Siemens AG of Germany built a tram line from Yongdingmen to Majiapu in Beijing. Since then, the first tram line in the Qing Dynasty was born in Beijing. However, this line didn’t run long, and Majiapu station was destroyed in the boxer movement the following year.

In the early years of the Republic of China, the traffic in Beijing was still dominated by rickshaws and animal rickshaws. At that time, the population of Beijing increased rapidly to 1.3 million. Facing the rapidly increasing population, the city traffic needs to be developed urgently.

In order to build Pukou trading port (Nanjing) and Beijing municipal construction, Beiyang government signed a "five-cent gold coin industrial loan contract" with Sino-French Industrial Bank in 1913, with a loan amount of 150 million francs. In the third year of the Republic of China (1914), the contract was renewed in Annexes 2 and 3, which contained the clause of "Building a Beijing Tram, which should be financed by Sino-French industry". However, there are many clauses attached to the contract that infringe on China’s sovereignty, such as the exclusive operation of the Beijing tram. This clause was opposed by the bureaucratic capital class in Beijing at that time. After the Beiyang government negotiated with France many times, the tram was changed to a joint venture between government and business.

In the third year of the Republic of China (1914), due to the outbreak of World War I, the western powers had no time to look east for hegemony, and the Beiyang government’s establishment of trams was temporarily put on hold. Prior to this, in the 30th year of Guangxu (1904), Tianjin signed a contract with Belgium to build a tram, and in 1906, Tianjin became the first city in China to build a tram. Shanghai followed closely, and in the thirty-fourth year of Guangxu (1908), a tram line was built. The tram in Beijing was not planned again until the tenth year of the Republic of China (1921).

On May 9th, 10th year of the Republic of China (1921), Zhang Zhitan, a representative of Beiyang government and supervised by Kyoto Municipal Office, and Cyril Baileji, a representative of France, formally concluded the "Beijing Tram Contract" based on the "Five Cents Gold Coin Industrial Loan Contract" and other documents. It is agreed that the capital stock quota of Beijing Tramway Company will be 4 million yuan, which will be shared equally by the government and businessmen, and the government will subscribe for half of it as official shares, which will be drawn from the French loan. Commercial shares are 100 yuan per share, which are subscribed by the public in registered form. According to the records at that time, there were hundreds of subscribers, most of whom were snapped up by bureaucrats and big capitalists, and a small number were bought by petty bourgeoisie.

In accordance with the commercial laws of China, Beijing Tramway Co., Ltd. (initially known as Beijing Tramway Co., Ltd., later known as Beijing Tramway Co., Ltd.) was formally established.

The company adopts the director system. The board of directors is composed of six government-owned directors and five commercial directors appointed by the government, with a total of eleven members. The first chairman was Wang Shizhen, a former army chief of Beiyang government. The Board of Directors has three divisions, namely, Engineering Division, Business Division and Accounting Division. One of the directors or deputy directors of each division must be the French. The actual control right of Beijing Tramway Co., Ltd. is in the hands of the French.

On June 30th, the 10th year of the Republic of China (1921), Beijing Tram Co., Ltd. held its founding meeting and began to plan the construction of trams. The most direct problem of tram operation is the power supply. Therefore, the establishment of self-owned power plants has become a top priority.

According to the report of the company’s engineering department, the daily water demand is 39,000 cubic meters based on the existing electricity of 3,000 kilowatts. However, there is a lack of water in Kinki, Beijing. If you dig wells to get water on the spot, it will not only cost a lot, but also be difficult to last. Therefore, it is most suitable to build the power plant by the river. The board of directors of Beijing Tramway Co., Ltd. instructed the engineering department of the company to be responsible for the site selection of power plants.

The factory building was initially destroyed by the flood.

In August of the 11th year of the Republic of China (1922), the site selection of power plants began. The surveyors of the Agency successively went to Yongding River in the western suburb of Beijing and North Canal in the eastern suburb to survey topography, hydrology and water quality. After the investigation and comparison of the two major rivers in Beijing, the surveyors think that the Yongding River is too fast and has a large rise and fall, so it will be unpredictable to build a factory next to the river. Moreover, Yongding River water contains more mud and sand impurities, which is not suitable for power generation. The North Canal, on the other hand, is different. It is not only rich in water and stable in water flow, but also has few impurities in water quality. At the same time, nearby rivers are being dredged. After the river flows into the North Canal, there is more water, so it is more suitable for building factories beside the river to generate electricity.

After investigation and repeated consultation and demonstration by engineering and technical personnel, Beijing Tram Co., Ltd. decided to build a power plant on the west bank of Tongzhou North Canal and the north of shed village.

Dapeng Village is located 5.6 kilometers southeast of Tongzhou City Center, bordering the North Canal in the east and Xiaoshengmiao Village in the south, and became a village in the Ming Dynasty. According to legend, in the early years, Xiaoshenmiao Village was called Xiaoshenmiao Village. In the temple in the village, the gods of river god riding Cyclops were enshrined to save the water monster. In the north of Xiaoshenmiao Village, next to the North Canal Passenger Terminal, there is a Guandi Temple, in which Guan Yu, a martial artist, is enshrined.

Temple monks set up a booth by the roadside outside the gate to give tea, with boatmen, merchants and squire villagers as tips to rest. For a long time, the settlements around Guandi Temple became villages, so the famous tea shed, also known as the tea shed Guandi Temple. In 1913, it was renamed as Dapeng Village.

Soon, it was convenient for the power plant to start construction in October 1922. Unexpectedly, in the process of construction, it experienced many obstacles, which lasted for six years.

One of the main reasons is that the projects of the power plant are designed by French engineers and technicians, who are arbitrary and do not consider and adopt the opinions and suggestions of Chinese engineers and technicians. Previously, directors Meng Yushuang and Liu Yifeng of Beijing Tramway Co., Ltd. invited Mr. South China Gui, a technical expert from China, to inspect the site. Mr. Hua raised an objection to building a factory by the river, thinking that the river will surge rapidly when the rainy season comes in the north, and the factory equipment will be destroyed. In order to ensure safety, it is suggested that the construction of the workshop should be far away from the river to avoid the impact of floods. However, the French side refused to accept Mr. Hua’s suggestion on the grounds that the factory is far from the river and the construction of another reservoir will increase the investment cost, and insisted on building the factory by the river.

Sure enough, as predicted by Mr. Gui of South China, in the summer of the 13th year of the Republic of China (1924), there was continuous heavy rain in Beijing, and the water in the North Canal rose sharply, which destroyed all the built water pump houses and reservoirs, so we had to design dams and rebuild the water pump houses and reservoirs. The flood not only caused great economic losses to the power plant, but also delayed the construction period.

Warlords scuffle power plants into battlefields

In addition to the French insistence, the social situation at that time also made the construction of power plants full of twists and turns.

At the beginning of the factory, in order to transport the required machine parts and materials, the power plant laid a 1.5-kilometer railway special line from Tongzhou East Railway Station, but it was opposed by the North Canal River Bureau and the villagers around the power plant, resulting in the stagnation of construction. The reason for the opposition of the River Affairs Bureau is that when laying the track, the power plant "actually bent and straightened the soil on the outer slope, and the soil taken was 50 feet away. Hundreds of willow trees were cut down on the two slopes, and the young trees were crushed." The reason for the villagers’ opposition is that if the power plant destroys the river bank, if the boiler of the power plant "explodes, the villages and cities within ten miles of the power plant will be in danger of being destroyed".

At that time, Tongzhou held two citizens’ meetings, and the citizens even issued the voice that "no matter how great the company’s power is, we will never propose those who are afraid of the situation and swear to resist it", and opposed the construction of a power plant in Tongzhou by Beijing Tramways Co., Ltd.

Beijing Tramways Co., Ltd. submitted an official document to Jing Zhaoyin’s office, arguing that "the reasons listed in the Tongzhou citizens’ meeting are by no means true, and the people who called the citizens’ meeting in the investigation were neither legal organizations nor main figures, so there is no doubt about it. However, since leaflets were issued, it is inevitable that they will not be confused and have an impact, which is actually related to local security …" Since then, under the repeated mediation of Jing Zhaoyin’s office, the power plant of Beijing Tramways Co., Ltd. has reached an agreement with the North Canal River Bureau and the citizens.

In addition, the chaos caused by the scuffle between the northern warlords made it difficult for the materials needed for power plant construction to arrive on schedule, which also delayed the construction time of power plant. In February of the 15th year of the Republic of China (1926), the warlord melee broke out again. This time, the power plant became the frontier. At the height of the fighting, the chimney in the factory became the target of artillery fire. "Under the bullet rain, the glass of the factory building was completely destroyed, and all the workers were buried underground … and the materials such as building blocks and stones were also lost". Fortunately, the plant and machinery and equipment of the power plant were not damaged, but the war delayed the construction period of the power plant again.

After May, although the war in the eastern suburbs gradually subsided, the war around the power plant continued. Because the trench is in front of the factory, the stones, sand, cement, refractory bricks and other materials needed for the construction of the power plant cannot be delivered.

Moreover, the power plant equipment is imported, generators are purchased from Switzerland, boilers are purchased from Britain, and electrical equipment is purchased from Germany. Due to the delay in the delivery of these imported equipment, the progress of the project is slow. It was not until September of the 16th year of the Republic of China (1927) that Tongzhou Power Plant was completed. On March 20th, 17th year of the Republic of China (1928), Tongzhou Power Plant officially generated electricity.

The old factory building left over from the former site of Tongzhou Power Plant. (photo by Qiu Chonglu)

Old images of Tongzhou power plant equipment in the 1940s.

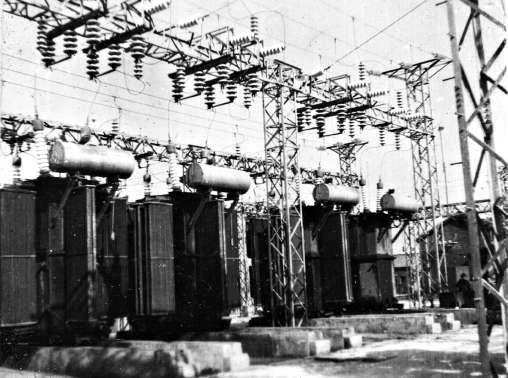

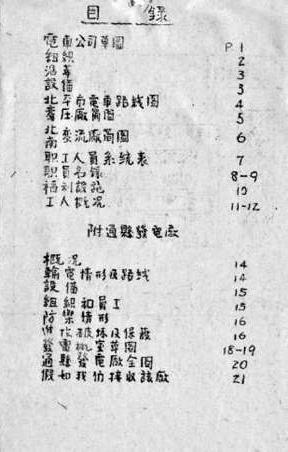

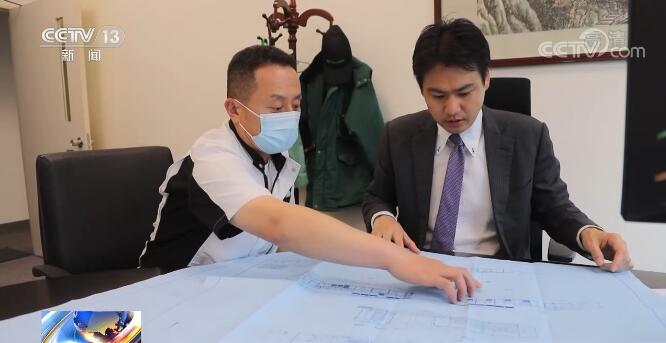

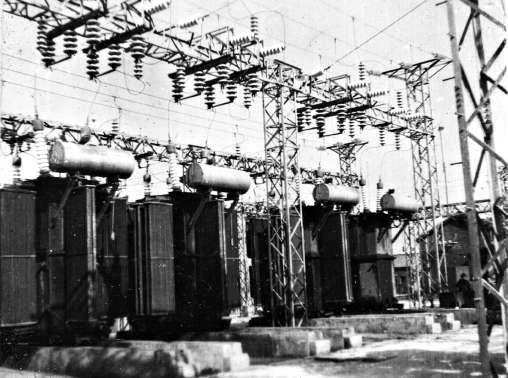

In 1948, the Ministry of Industry of the North China Bureau of the Communist Party of China arranged an underground party organization to draw detailed information of Beijing Tram Company, and the second picture was the protection map of Tongzhou Power Plant.

The power plant supplies power to Tongzhou city.

In December of the 13th year of the Republic of China (1924), Beijing trams were put into operation. However, the power plant in Tongzhou is still under construction. During this period, Beijing Tram Co., Ltd. used the electricity for trams, which was purchased from Jingshi Huashang Electric Company. On November 30th, 13th year of the Republic of China (1924), the two sides signed a power supply contract. When the Tongzhou Power Plant of Beijing Tramwork Co., Ltd. needs power before or after it is started, it will be supplied by Jingshi Huashang Electric Company. After the Tongzhou Power Plant of Beijing Tramway Co., Ltd. started to generate electricity, the surplus electricity was sold to Jingshi Huashang Electric Company.

In March of the 17th year of the Republic of China (1928), Tongzhou Power Plant of Beijing Tramways Co., Ltd. began to generate electricity. Besides supplying the trams in Beijing, the remaining electricity was sold to Huashang Electric Light Co., Ltd., Sunhe Pumping Station of Beijing Water Supply Company and Shuangqiao area.

It is worth mentioning that Tongzhou Power Plant of Beijing Tramway Co., Ltd. also provided convenience for Tongzhou City at that time. Previously, the electricity in Tongzhou City was mainly provided by Tongzhou Electric Company Limited. Tongzhou Electric Light Co., Ltd. was founded in the seventh year of the Republic of China (1918). Chinese Zhang Zipei and Lin Jiwu raised 90,000 silver dollars in Chinese capital stock, and purchased a DC generator driven by a 75 kW steam engine from American Sydney Electric Company, which was completed in the same year. At that time, there were 12 power supply lines in Tongzhou city, and the users of power supply were government agencies, foreign churches, Xihaizi warehouses, hospitals, schools, small industrial and commercial households and a few residents in Tongzhou city.

After the eleventh year of the Republic of China (1922), the industry and commerce in Tongzhou area developed rapidly, and there was a shortage of electricity supply and occasional power outages, which was strongly reflected by users. In March of the 17th year of the Republic of China (1928), after the power generation in Tongzhou Power Plant of Beijing Tramwork Co., Ltd., Tongzhou Electric Co., Ltd. entered into a power purchase contract with the power plant to solve the problem of power shortage in Tongzhou.

Since the 17th year of the Republic of China (1928), Tongzhou Power Plant has supplied an average of 55,000 kwh of power to Tongzhou city every month, which is only one tenth of the total power generation, and has increased year by year since then. With the power supply of Tongzhou Power Plant, automatic telephone, tap water and processing industry have been developed in Tongzhou city. Tongzhou Power Plant of Beijing Tramway Co., Ltd. was relatively advanced at that time, both in terms of power generation equipment and plant scale. In the 19th year of the Republic of China (1930), the generator set of Tongzhou Electric Co., Ltd. was shut down and the equipment was sealed. At this point, the electricity consumption in Tongzhou area is all supplied by Tongzhou Power Plant of Beijing Tramway Co., Ltd.

Unite as one to crush the Japanese conspiracy

After the July 7th Incident, Tongzhou fell, and the Japanese aggressors attempted to take over the power plant by force, but they were unanimously opposed by the Chinese and French shareholders. They suggested that if they wanted to take over the power plant, they must buy all the shares in cash, so the Japanese aggressors’ plot failed. However, the Japanese invaders were not reconciled, but they were not allowed to increase the tram fare during the period of soaring prices, in an attempt to bring down the tram company and achieve the purpose of occupying the power plant.

Around 1944, the so-called "strengthening public order" was carried out because of the Japanese invaders’ crazy plunder, which caused the market depression and the number of passengers dropped sharply. The income of employees in power plants changes with the operation of tram companies, so the power plants have deficits year after year. Under difficult conditions, the workers gritted their teeth in unity, overcame difficulties and crushed the plot of the Japanese aggressors. After the victory of the Anti-Japanese War, the French shareholders withdrew all their shares, and the Tongzhou Power Plant of Beijing Tramway Co., Ltd. was completely managed and operated by Chinese himself.

In 1944, the anti-Japanese armed forces in Jidong were active frequently. After the victory of the Anti-Japanese War, according to the Central Committee of the Communist Party of China’s "Instructions on Urban Work", the 14th division of Jidong instructed Zhang Shien, an underground party member of the power plant, to work in the factory. At the end of 1945, Zhang Shien secretly developed five underground party member and established an underground party organization. He did a lot of work to win over and organize the masses by fighting for the welfare of workers, which greatly weakened the influence of the Kuomintang in the factory.

In the winter of 1948, on the eve of the liberation of Tongzhou, the power plant faced another severe test. The 13th Army of Kuomintang (KMT) stationed in the power plant, set up Abatis around it, built bunkers in greenhouses and other places, buried a large number of mines, and ordered the forced demolition and felling of houses and trees outside the factory to cover the line of sight. The atmosphere was very tense.

In order to protect the power plant from being destroyed by the Kuomintang, the workers formed a factory protection team under the leadership of the underground party organization headed by Zhang Shien. The factory protection team called on the workers of the whole factory to stay in the factory, and put forward the slogan of "swearing to live and die with the power plant". Under the close watch of the workers, the reactionary Kuomintang army never dared to act rashly, and then fled in haste. When Tongzhou was liberated, the underground party organization of the power plant welcomed the comprehensive takeover of the power plant by the 14th district. Before 1949, there were more than ten people in party member underground of Tongzhou Power Plant. In 1950, Tongzhou Power Plant formally established the CPC Beijing Tram Company Tongzhou Power Plant Party Branch.

After 1949, with the improvement of people’s living standards, the demand for power supply increased sharply. Tongzhou Power Plant not only mainly supplies trams with electricity, but also supplies part of Beijing Electric Power Bureau and waterworks, and supplies power to Shuangqiao Radio Station and Sanjianfang Airport, in addition, there is still power generation margin. In order to adjust the surplus and deficiency and give full play to the equipment capacity, Tongzhou power generation and supply system was connected and merged with Beijing power grid in 1953 for unified dispatching.

In 1954, Beijing Electric Power Bureau and Beijing Tramway Co., Ltd. agreed to transfer Tongzhou Power Plant and its transformer plant located in Dongchenggen outside Chongwenmen to Beijing Electric Power Bureau for professional management. Since then, Tongzhou Power Plant has separated from Beijing Tramway Co., Ltd. and become a power generation unit of Beijing Electric Power Bureau. In 1955, Tongzhou Power Plant was expanded to install additional power generation equipment.

Since then, a large power plant with a capacity of 200,000 kilowatts (formerly Dongjiao Thermal Power Plant, later called Beijing No.1 Thermal Power Plant) has been built in the eastern suburb of Beijing, about 20 kilometers away from Tongzhou Power Plant. Tongzhou power plant was affected, and the equipment in the plant was moved to another place lacking electricity.

On March 28th, 1964, Tongzhou Power Plant officially stopped generating electricity. Since then, Tongzhou Power Plant has completed its historical mission. (Qiu Chonglu)