Product | company research room

Text | cookie

Recently, the performance of Xiaomi eco-chain enterprises in the capital market is very eye-catching.

Roborock, which was listed in science and technology innovation board in February, has become the second highest-priced A-share stock, with a closing price of 867.05 yuan on November 4th, second only to Kweichow Moutai. On October 29th, the second Xiaomi eco-chain enterprise No.9 was listed in science and technology innovation board, with an increase of 103.27% on the first day. As of November 4th, the market value of No.9 was 38.3 billion.

These two companies have achieved rapid development in just five years after joining the Xiaomi ecological chain, and now they have become companies with annual income exceeding 4 billion. However, after listing, it is not a long-term solution to develop into a larger enterprise by relying solely on Xiaomi. They all have a long way to go to "millet".

Why do Roborock and No.9 Company belong to Xiaomi Ecological Chain?

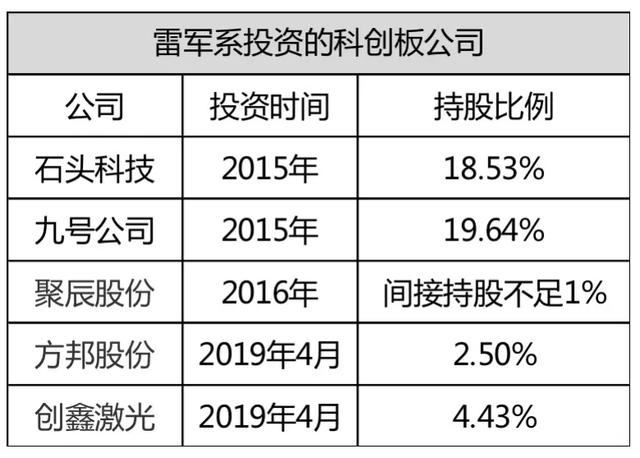

As a well-known angel investor, Lei Jun, the boss of Xiaomi Group, can be regarded as the invisible promoter of science and technology innovation board Company. In April 2019, when science and technology innovation board began to accept the application materials, at least five companies directly or indirectly invested by Lei Jun launched an attack on science and technology innovation board, including Roborock, No.9 Company, Juchen Company, Fangbang Company and Chuangxin Laser.

Of these five companies, four except Chuangxin Laser have successfully listed in science and technology innovation board. At the end of October, Chuangxin Laser officially decided to withdraw the relevant application materials of science and technology innovation board IPO to terminate its listing, which was the first time that Lei Jun failed in science and technology innovation board.

Although they are all invested by Lei Jun, Roborock and No.9 Company are slightly different from the other three companies. First of all, Lei Jun, the capital of these two companies, intervened earlier and held more shares. Secondly, it has a close relationship with Xiaomi. In the words of Lei Jun, it is "one of the earliest members of the Xiaomi ecological chain family."

Roborock was founded in 2014, and started out as an OEM Xiaomi sweeping robot. In 2015, it obtained Shunwei Capital and Tianjin Jinmi Investment from Lei Jun Department. After the company went public, Shunwei Capital held 9.64%, Tianjin Jinmi held 8.89%, and Lei Jun Department held 18.53% of the total shares.

Company No.9 was established in 2012, and its products include intelligent electric balance car and intelligent electric scooter. In the A round of financing in 2015, Shunwei Capital and People Better investment were obtained, among which People Better is the wholly-owned grandson company of Xiaomi. After the company went public, People Better and Shunwei Capital each held 9.82%, and Lei Jun held 19.64% of the total shares.

However, Fangbang shares and Chuangxin Laser only acquired the surprise shares of Lei Jun Department a few months before submitting the prospectus, and the shareholding ratio was not high. At present, Hubei Xiaomi Changjiang Industrial Fund only holds 2.50% of Fangbang shares.

With the rapid development of Xiaomi’s "halo" scale.

Roborock and No.9 Company have achieved rapid development after being invested by Lei Jun Department and becoming Xiaomi ecological chain enterprises.

In 2016, Roborock began to develop "Mijia Intelligent Sweeping Robot" for Xiaomi. In 2017 and 2018, Roborock successively launched its own brands of "Stone Intelligent Sweeping Robot" and "Xiaowa Sweeping Robot", and its revenue increased from 183 million to 4.205 billion. However, the growth rate of Roborock’s income has been declining year by year. In the first three quarters of 2020, the income was 2.98 billion, down 1.65% year-on-year.

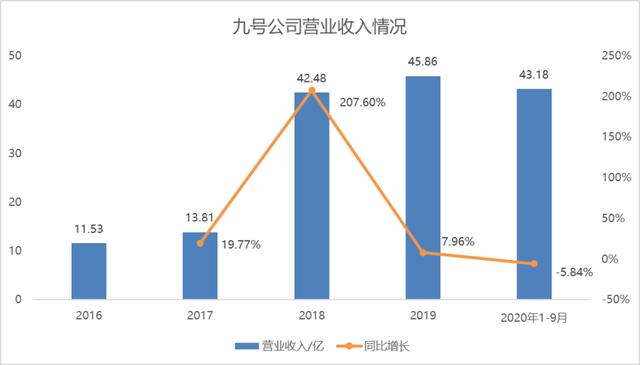

Similar to Roborock, Company No.9 obtained the key fund to acquire Segway, the world’s largest balance car company, after obtaining Xiaomi investment in 2015, which became a turning point in the company’s development. However, since 2018, the revenue of Company No.9 has slowed down. In the first three quarters of 2020, the revenue was 4.318 billion, down 5.84% year-on-year.

According to the analysis of brokerage research report, the two companies relied on Xiaomi’s strong ecological potential in the early days of their establishment to quickly and smoothly spend the initial stage of the enterprise, which provided a good foundation for the subsequent development of their own brands. In the early days of the company’s establishment, Xiaomi found stable and high-quality suppliers for No.9 and Roborock with its brand advantages. Three of the top five suppliers in Roborock are also major suppliers of Xiaomi, namely Xinwangda, Side Battery and Avnet Technology.

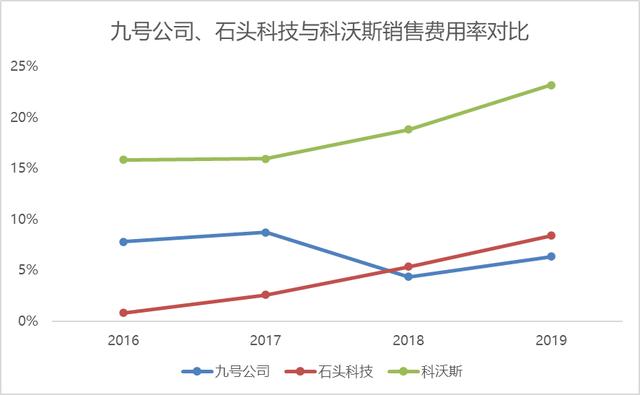

In addition to the help of funds and suppliers, Xiaomi also has a huge user base, as well as strong online channels and extensive offline channels to help eco-chain companies quickly open the market. Eco-chain companies have advantages in sales. In 2019, the sales expense ratio of No.9 was 6.35%, the sales expense ratio of Roborock was 8.42%, and the sales expense ratio of similar companies was 23.19%. The sales expense ratios of the two companies were obviously low.

In the first three quarters of 2020, the net profit of Company No.9 returned to its mother was 85 million, and it finally achieved profitability. From 2016 to 2019, the company accumulated losses of 2.947 billion. In contrast, Roborock has a good profitability, with a net profit of 899 million in the first three quarters of 2020, a year-on-year increase of 54.47%.

The two companies grew up from scratch. In just five years after receiving Xiaomi’s investment, they succeeded in the two sub-sectors of sweeping robot and balance car respectively, which is closely related to Xiaomi’s help.

However, Xiaomi is mainly cost-effective, and supplying Xiaomi will greatly reduce the company’s gross profit margin.

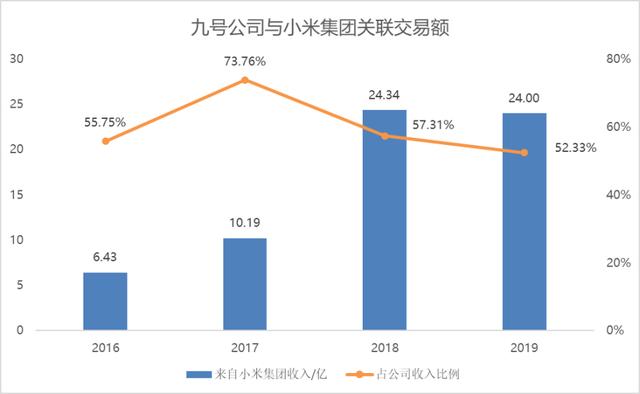

Take Company No.9 as an example. The average unit price of the same product sold to Xiaomi is 15%-20% lower than the average selling price of the company. In the past three years, the gross profit margin of products sold to Xiaomi has decreased year by year. Roborock is similar to No.9. In 2018, the gross profit margin of Mijia sweeping robot was 14.99%, while that of stone sweeping robot was as high as 42.06%, a full difference of 27.07 percentage points.

The Difficult Road for Eco-chain Enterprises to "Millet"

The two companies quickly opened up the market awareness by OEM for Xiaomi, but relying solely on Xiaomi’s platform is not enough to support its long-term development. Therefore, Xiaomi eco-chain enterprises such as Huami, Stone and No.9 have started to launch their own brands, expand sales channels and promote "millet" after they started their brands.

For example, while Roborock and No.9 Company sell their own brands through Xiaomi’s channels, they cooperate with e-commerce channels such as JD.COM, Suning and Tmall, and go hand in hand online and offline.

However, it is not easy to "millet".

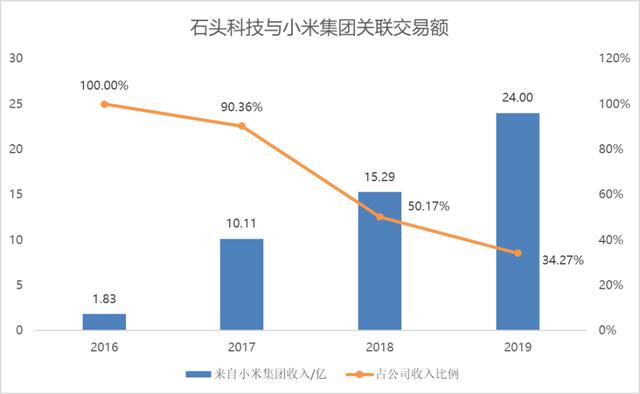

From 2016 to 2019, the first customers of the two companies were Xiaomi Group. In 2019, Roborock’s income from Xiaomi was 1.441 billion, accounting for 34.27%; Company No.9′ s revenue from Xiaomi was 2.400 billion, accounting for 52.33%. In terms of income, the income of the two companies from Xiaomi showed a downward trend. However, the decline in the purchase amount of Xiaomi in 2019 led to a sharp slowdown in the revenue growth of the two companies, and Xiaomi can still have a greater impact on the company.

Although Roborock’s dependence on Xiaomi has decreased significantly, there are still hidden dangers in the company’s development. The products are single, and the revenue of sweeping robot business accounts for 98%.

At present, the sweeping robot industry is still in the development stage, with more than 200 brands on the market and fierce competition in the industry. The data shows that from 2014 to 2019, the retail sales of sweeping robots in China increased from 2.2 billion to 8 billion, with a compound annual growth rate of 29%. The top three brands in the domestic market are Cobos, Mijia and Stone, with market share of 49.4%, 12.0% and 11.1% respectively. Although the market share of stone’s own brand ranks third, many of them are brought by Xiaomi aura. If we get rid of Xiaomi and rely on stone itself, will it still be competitive?

Company No.9 is similar to Roborock. According to the prospectus of Company No.9, the compound annual growth rate of China’s balance car production is only 2.3% from 2015 to 2019, and the demand in 2019 is only 3.9 million units, which is less than 25% of the production. The development space of the balance car market is not high. Moreover, No.9 is more dependent on Xiaomi in terms of income, and it is even more difficult to "millet".

The ultimate success of Xiaomi eco-chain enterprises is that every enterprise has the ability of self-survival, making efforts in products, channels, supply chains and other aspects, and gaining a bigger market and achieving higher returns on the basis of Xiaomi platform. It’s just a difficult road to "millet".

关于作者