Text | Wu Lingwei

Editor | question

From the beginning of 2021, the cosmetics industry ushered in the strongest supervision: the basic law of the industry, the Regulations on the Supervision and Administration of Cosmetics, was officially implemented. In the second half of the year, more rational investment also cooled the fiery atmosphere of the beauty industry in the past few years.

But there is no doubt that China has become a huge market for the beauty industry. In this market with a scale of 500-600 billion yuan or even larger, P&G has the CEO Xu Min trained in China for the first time in its corporate history in 184, and the newly-established president and CEO of Estee Lauder Group in China is also the first completely local leader in China.

These changes are also confirmed from the consumer side. Cindy, general manager of Tmall Beauty Industry, said that although mainstream brands still occupy a large part of the market, new brands are infiltrating younger people through new categories. The beauty industry, which seems to have become a red sea, is constantly emerging new opportunities because of technological innovation and unsatisfied demand from consumers. In the second half of 2021, due to the innovation of beauty preservation technology, freeze-dried mask became a new trend. Online consumption continues to upgrade, and the unit price of customers purchased is also higher.

Domestic brands including Polaiya and Baique Ling, cutting-edge brands such as Hua Xizi, Perfect Diary and Colorkey, popular line brands such as Ya Yang and Nuxi Mystery, and luxury beauty brands such as Hermes perfume beauty cosmetics, Givenchy and Dior beauty cosmetics participated in the discussion. The topic discussed together is, where will the beauty brands go in 2022?

In September 2021, perfume, men’s and pets and tide play were separated from the original industry and operated independently, becoming an independent category of Tmall. In fact, the upward trend of these major categories is by no means a grass ash snake line, which has long been obvious to all.

Consumers who used to know only Chanel, Burberry and other major "duty-free shops" perfume, in double 11 in 2021, all perfume brands that were originally regarded as "niche" such as Zumalong, Mei Sen Magira, Diptyque, Pan Hailigen and BYREDO were sent to Tmall Million Club. Fauvism and Bing Xili, who started online, are China players whose sales exceed 10 million.

This not only reflects the change of salon perfume or niche perfume entering the field of vision of mass consumers, but also domestic perfume players are being attracted by this tens of billions-level track and entering the game. In addition to the smell library, which was born earlier and has been stationed in many shopping malls, Scentooze Three Rabbits, born in 2019, entered the offline beauty collection stores such as Xiyan, while Guanxia and Wenxian opened more experience-oriented flagship stores on Hunan Road and Huaihai Middle Road in Shanghai.

* Left: Wenxian’s flagship store in Huaihai Middle Road, Shanghai; Right: The Summer Sightseeing Lounge on Hunan Road in Shanghai.

In addition, Galand, a cosmetics group, launched its first perfume brand, ASSASSINA Sahina, and Emotif, ByteDance’s own fragrance brand, will be on sale soon. Service providers who set foot in the e-commerce business earlier are also introducing foreign perfume brands that Chinese people are not familiar with by proxy operation. Youke Group is the trader behind Creed Tmall International Store, which is known as the "British royal perfume brand", and Shuiyang shares also operate the overseas flagship store of French luxury perfume MEMO PARIS.

Scenes for the use of perfume fragrance are also being broadened. Bedroom fragrance, space fragrance, car fragrance, bathroom fragrance, etc. introduced according to different scenes, as well as clothing fragrance and sleep-aiding fragrance introduced in combination with users and purposes, are also occupying consumers’ sense of smell.

In addition to fragrance, Cindy predicts that men’s care and beauty instruments will also become the trend category of makeup and skin care in 2022.

Cindy, General Manager of Tmall Beauty Industry

She found that boys also began to "please themselves". "Originally, boys bought perfume, which was probably for girls, but since June 18, 2020, the proportion of boys buying perfume by themselves has been higher."

In the Tmall flagship store of the men’s skin care brand Li Ran and her dear boyfriend, perfume has always been one of the highest-selling categories in the store; The ratio of male and female users of the domestic fragrance brand "Beast Youth" reached 4: 6.

Moreover, these new brands seem to quite understand what "masculinity" China men want. Men want to conceal their flaws, but they can’t be seen to be wearing makeup; They are too troublesome and afraid of being greasy. They hope that they can spread the foundation evenly without beauty eggs, and they are even more reluctant to make great efforts to remove makeup. Their psychological barriers even affect their acceptance of foundation and BB cream-these categories used to be dominated by women. Therefore, JACB, Liran and other brands have launched their own men’s face cream, mainly to solve the boys’ need to pay attention to it and be troublesome.

The new brand of Su Yan Cream, which is specially designed for men, has grasped the boys’ demand of "being particular and troublesome".

Although Neil Chapman, the godfather of perfume, said in the perfume Bible that most minority perfume manufacturers are designing for individuals, regardless of gender ("for men" and "for women" are out of date for contemporary brands). However, at the present stage, those domestic perfume or skin care brands specially designed for men still need to promote "men’s perfume" or "men’s skin care brand" to show their identity as new consumer goods and distinguish them from past brands.

The bonus of beauty and body instruments comes after consumers have been educated by beauty brands for many years. This high-order, more professional category faces a group of "technical streams" who have higher requirements for skin care and are more willing to accept new ideas, or consumers who are still in the wait-and-see period for medical beauty and temporarily transition to home beauty instruments.

But in the past, this high-end skin care market monopolized by foreign brands began to be gradually opened by domestic brands. The new brand Tingyan, which was founded less than three years ago, opened up the young market with home cinema-level skin care products and instruments. Last year, double 11 ranked among the TOP20 of Tmall in its elite category.

On Tmall, there are not a few cutting-edge domestic brands like Tingyan. Based on the insight into the domestic consumption ecology, we dig deep into the user’s segmentation demand scenarios and achieve overtaking in corners. The most important thing is that it has changed the way of many domestic brands "replacing big brands" in the past, but directly cut into the field of instruments with heavy assets and heavy research and development.

In the highly competitive cosmetics industry, there are still quite a few unmet needs. "The greater the differentiation of user needs, the more difficult it is to form a monopoly," Zhu Xiangyu said.

In the past few years, many new domestic beauty brands have achieved the unification of users, needs, scenes and pricing, and reached a certain business volume by relying on several explosive products. But explosive products are only a means of short-term brand growth or being seen, and they have their own life cycle. And brands need to rely on more goods, even more product lines or brands to maintain the growth rate of continuous development.

Therefore, the question before many brands is, "should I open a new product line or recreate a new brand?"

According to Zhu Xiangyu, a partner of Zhonglin Capital, there is no standard answer to this question. "Don’t make a second brand before you make a brand from 0 to 1 and from 1 to 10. Because of an entrepreneurial project, resources and energy are limited. "

However, the direction that brands can consider is to find their own skills development points. Beauty and Muji, which seem to have no explosions in various fields, take a large and comprehensive "all-category road": beauty has penetrated almost all small white household appliances, and has become the top spot in many categories, making itself an industry expert; Muji, on the other hand, covers home textiles, stationery, clothing and other categories and becomes a representative of a lifestyle. It’s just that their category expansion direction has extremely high requirements for brands, which is "impossible to meet".

Learning from Dyson and Yunnan Baiyao is more suitable for new brands with obvious long and short boards: Dyson has made a thorough study of "wind", from air purifiers, electric fans to hair dryers, which are in line with consumers’ cognition of its professional skills; From the cross-border of traumatic drugs to toothpaste, Yunnan Baiyao has not broken away from the professional field of "diminishing inflammation and removing swelling".

Ma Yinglong, a cross-border beauty makeover.

Fan Weiliang, director of e-commerce operations of New Zealand Mystery, said that those brands seeking breakthroughs in the 10-100 stage need to launch product line matrices such as image models, drainage models, profit margins and trend models suitable for brand tonality. At the same time, we must attach importance to the construction of the old customer flow pool and the repurchase marketing of members, and we must also attach importance to the construction and application of the enterprise data center. From product research and development to listing promotion, from new customer joining to old customer repurchase, it is driven by data, and it is forbidden to slap the head.

In recent years, among the confident social thoughts of big countries, the "national tide" that began to churn in 2016 has not subsided, but has extended from the concept of fashion clothes to consumer goods.

A number of domestic brands such as Baiqueling, herborist and Lin Qingxuan have also become popular in the national tide. These brands, which used to rely more on offline traditional business, have short contact time and are far away from young consumers.

However, the director of the operation of Tmall Beauty’s domestic product line also said that after double 11 last year, several important changes have taken place in the consumer groups of domestic brands:

1. Young consumers of domestic brands account for more than 52%. Compared with the previous big promotion, domestic consumers began to be younger.

2. Consumers of domestic brands migrate from the original third-and fourth-tier cities to the first-and second-tier cities, which means that domestic brands have a better brand image among the main beauty groups.

3. Compared with the past, domestic consumers are more "senior" beauty buyers, indicating that consumers recognize the quality of domestic brands more.

Old-fashioned domestic products that seize new channels and new people.

When domestic beauty brands enter consumers’ hearts with more professional brand image and product quality, they should do their own product innovation, "do what is not a fire", Zhu Xiangyu said. For the excavation of China culture, we should not only show that "it is not carving dragons and phoenixes on packaging, but it is more suitable for the aesthetics of China people in product aesthetics, material expression and even scenes."

The most important point is the digitalization process of brands. Even though "digital transformation" has been mentioned for many years, international brands are still in a relatively advanced position. Few domestic brands (especially new brands) will systematically manage marketing materials, efficiency tools and delivery tools.

On the same day, when Cat proposed to become a D2C platform in October 2021, it also threw out the "two-wheel drive" methodology that the brand should focus on consumer operation and goods operation. The beauty industry is a typical industry driven by consumer operations. It values accurate insight into consumer needs and also needs to tap those potential trend tracks. At the moment when multi-platform operation has become the norm, a beauty brand will open stores in online and offline channels such as Tmall, Applet and JD.COM at the same time, and will also plant grass in Xiaohongshu, Weibo and Tik Tok. How to make a potential user who is still unfamiliar with his own products become his own consumer and member, and keep buying again is the proposition of all brands.

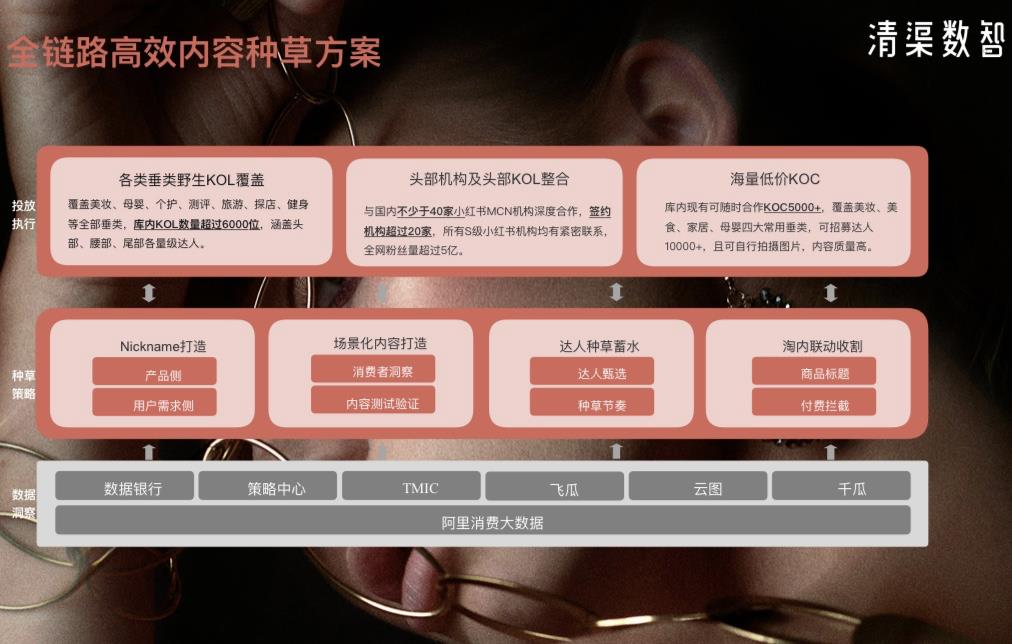

"The combination of data and marketing is the core growth point of brand new content planting grass. Optimizing the complete link of Nickname creation, scene content production, high-value talent cooperation and Amoy linkage through data insight will greatly enhance the efficiency of brand new content planting grass." Olivia, deputy general manager of Qingqu Digital Intelligence, said.

Especially those big brands that have reached a considerable scale attach great importance to the consistency of consumer experience in all channels. But a consumer’s "whereabouts" are uncertain: they may try to place an order while shopping offline and complete the repurchase on Tmall. Offline BAs often tell consumers how to use points, so as to constantly stimulate consumers to buy and save points. If consumers are faced with a set of membership points system that has not yet been opened, they are likely to lose their loyalty to the brand, and the brand will lose the opportunity to raise the unit price of customers. Therefore, the service providers who trade brands not only have to get through the membership system, but also have to make online customer service "become" the role of offline BA, so that consumers can get more consistent services online and offline.

In the process of realizing these methodologies, we need the support of digital operation tools. And these infrastructure and capacity-building can not be completed by the brand itself. In the meantime, in addition to the infrastructure provided by the platform, many brands have chosen service providers with mature brand trading experience and more e-commerce operation capabilities to help.

Nowadays, both the founders of new brands and the traders of domestic brands know the value of "brand": when consumers face a known brand, the decision-making chain will be shorter and the time will be less. The premium and gross profit brought by the brand can help the brand to force the supply chain to make continuous supply, provide better products for consumers, and extend the life cycle of the brand. However, on the way to becoming an evergreen brand, it will always be a compulsory course for the brand to fill in the shortcomings, consolidate the cultivation of the long board and the methodology of digital management.

关于作者