November 3 rd

Shizhong DistrictopensevenCOVID-19 vaccination site

All inoculation sites provide a third dose of booster vaccination.

Let’s take a look at tomorrow’sVaccination information in COVID-19

Shihao Square Inoculation Point:

For all people over the age of 18 who need to be vaccinated with the first and second doses of inactivated vaccine; Persons who meet the requirements and need to be vaccinated with booster shots (the second dose has been vaccinated for 6 months); Make an appointment on the spot and queue up for vaccination in an orderly manner.

Vaccination time: 13: 30-19: 30, which will last until the reserved number is planted on the same day. It is estimated that 700 doses will be inoculated, and the vaccine type is inactivated vaccine (Kexing, Zhongsheng).

COVID-19 Vaccination Point in Suji Town:

aim atAll people over the age of 12 who need to be vaccinated with the first and second doses of inactivated vaccine; Persons who meet the requirements and need to be vaccinated with booster shots (the second dose has been vaccinated for 6 months); On-site orderly queuing inoculation .

Inoculation time: 13: 30-16: 30, onesix:three0After that, no new queue will be added.It is estimated that 600 doses will be inoculated, and the vaccine type is inactivated vaccine (Kexing, Zhongsheng).

COVID-19 Vaccination Point of Shanghe Street Street:

aim atAll people over the age of 12 who need to be vaccinated with the first and second doses of inactivated vaccine; Persons who meet the requirements and need to be vaccinated with booster shots (the second dose has been vaccinated for 6 months); On-site orderly queuing inoculation .

Inoculation time: 13: 00-17: 00, oneseven:00After that, no new queue will be added.It is estimated that 700 doses will be inoculated, and the vaccine type is inactivated vaccine (Kexing, Zhongsheng).

COVID-19 Vaccination Point of Zhanggongqiao Street:

aim atAll people over the age of 12 who need to be vaccinated with the first and second doses of inactivated vaccine; Persons who meet the requirements and need to be vaccinated with booster shots (the second dose has been vaccinated for 6 months); On-site orderly queuing inoculation .

Inoculation time: 13: 00-17: 00. No new queue will be added at 17:00.It is estimated that 700 doses will be inoculated, and the vaccine types are as follows inactivated vaccine(Kexing, Zhongsheng) .

COVID-19 Vaccination Point in Tuzhu Town:

For all people over the age of 12 who need to be vaccinated with the first and second doses of inactivated vaccine; Persons who meet the requirements and need to be vaccinated with booster shots (the second dose has been vaccinated for 6 months); On-site orderly queuing inoculation.

Inoculation time: 13: 30-16: 30. No new queue will be added at 16:30.,It is estimated that 600 doses will be inoculated, and the vaccine type is inactivated vaccine (Kexing, Zhongsheng).

cogongrassbridgetownnewcrown/crestepidemic diseaseseedlingreceivegrowpoint:

needlerightAll people over the age of 12 who need to be vaccinated with the first and second doses of inactivated vaccine; Persons who meet the requirements and need to be vaccinated with booster shots (the second dose has been vaccinated for 6 months); On-site orderly queuing inoculation .

receivegrowtimebetween/separate/space in between/room:13:30—onesix:three0,onesix:three0Don’t add a queue after.,in advancecountreceiveSpecies 600dosetime,epidemic diseaseseedlinggrowkindforput outaliveepidemic diseaseseedling(Kexing, Zhongsheng) .

throughriverstreetwaynewcrown/crestepidemic diseaseseedlingreceivegrowpoint:

For all people over the age of 12 who need to be vaccinated with the first and second doses of inactivated vaccine; People who need to be vaccinated with the second and third doses of recombination vaccines (excluding people aged 12-17); Persons who meet the requirements and need to be vaccinated with booster shots (the second dose has been vaccinated for 6 months); On-site orderly queuing inoculation.

receivegrowtimebetween/separate/space in between/room:13:00—17:00 No new queue will be added at 17:00.in advancecountreceiveSpecies 600dosetime,epidemic diseaseseedlinggrowkindforput outaliveepidemic diseaseMiao (Kexing, Zhongsheng) and recombination vaccines (Zhifei).

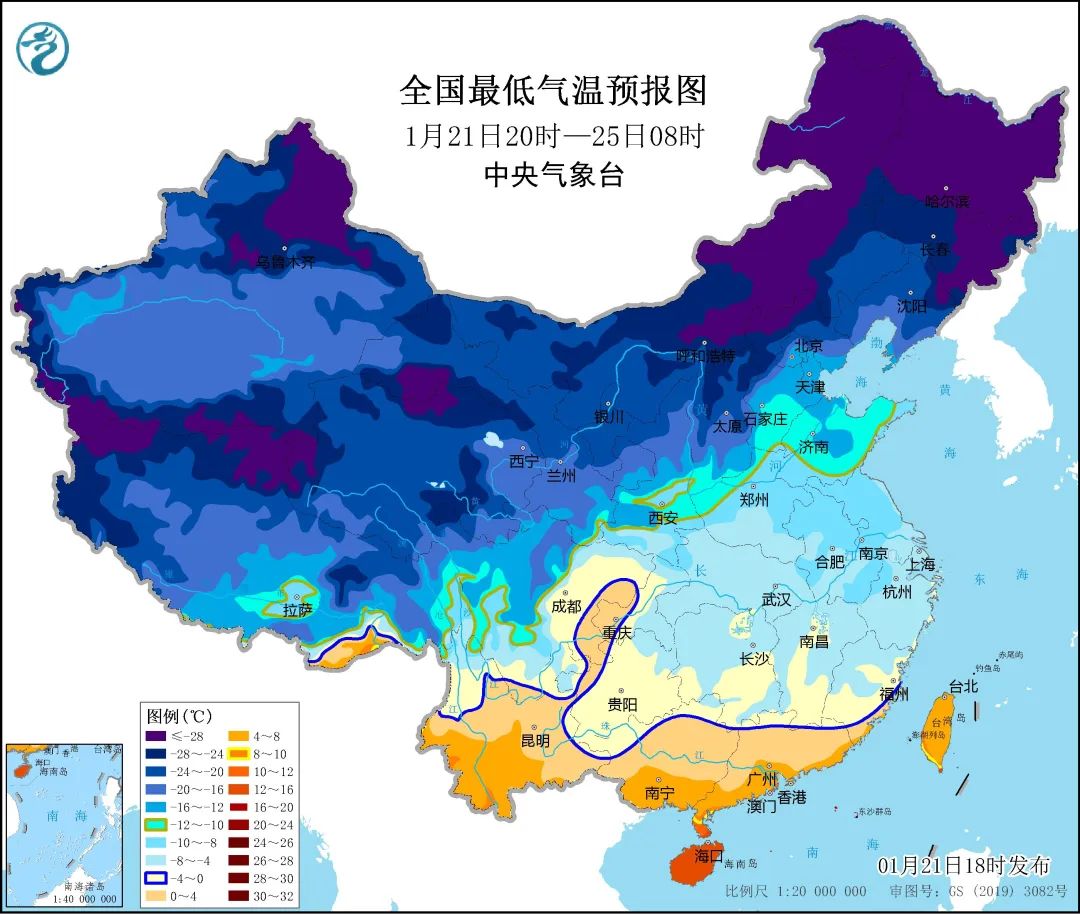

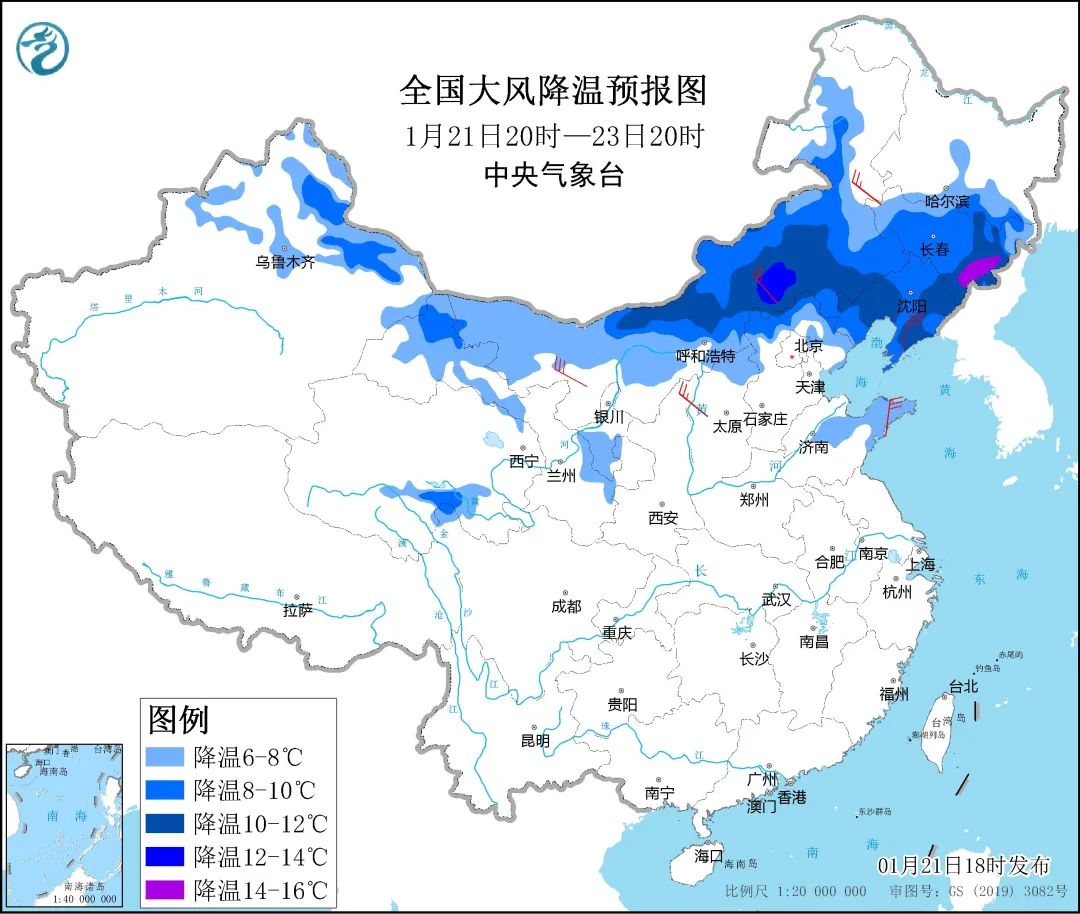

temperaturepervasive fragrancecarryshow

pleaseeachplacecitythe peoplereasonnaturerowteamreceivegrow.eachpointplaceepidemic diseaseseedlinghavelimit,beatfinishnamelystop.

onetwo o’clock—one2:three0fordoctoraffairhumanmemberexchangeclasstimebetween/separate/space in between/room,builddiscussfrontcomereceivegrowofcitythe peoplebe able to bear or endureheartwait forwait.

Sichuan CDC reminds you

︾

manage and control measures

According to the press conference on epidemic prevention and control held in Inner Mongolia Autonomous Region on October 30th, the passenger transport functions of railway and highway ports in Inner Mongolia were all suspended. Manzhouli Railway and Highway Port, Erenhot Railway and Highway Port, Ganqimaodu, Ceke, Mandula, Zhungadabuqi and Ebudug Highway Port keep freight traffic. Recently, customs clearance at Erenhot Highway, Ceke and Zhungadabuqi ports was suspended due to the epidemic.

On October 31st, according to the news of @ Shanghai Disneyland, it was informed by other provinces and cities that in order to cooperate with the epidemiological investigation of COVID-19 epidemic, Shanghai Disneyland and Disney Town stopped visitors from entering immediately. Some amusement equipment in the park will temporarily stop running and outdoor performances will continue. Visitors should strictly take prevention and control measures such as wearing masks and keeping social distance. On October 30-31, those who came to (returned to) Sichuan with a history of living in Shanghai Disneyland and Disney Town were tested for nucleic acid twice within 3 days (with an interval of 24 hours), and they were all negative, and they were included in community management and health monitoring until they left their place of residence for 14 days.

(Click to view larger image)

Expert advice

It is suggested to take the initiative to do a nucleic acid test and self-health monitoring for 14 days after traveling from other provinces and returning to Sichuan on business. Once you have symptoms such as fever, dry cough, fatigue, sore throat, decreased sense of smell, diarrhea, etc., go to the fever clinic of a nearby hospital as soon as possible, and inform the doctor of his residence history, and don’t take medicine by himself; Wear a mask all the way to the hospital and avoid taking public transport.

If it is not necessary, please try not to go to middle and high risk areas or areas with reported cases, and insist on washing hands frequently, ventilation, wearing masks and rice noodles every day.

In the absence of contraindications, please ask eligible people to get Covid-19 vaccine and influenza vaccine as soon as possible.

Control measures for people coming (returning) to Sichuan in some parts of China

manage and control measures

Involved area

Implement home or centralized isolation, everythreeTianjinoneSub-nucleic acid detection, until leaving the residence.14God forbid.

Erenhot City, Xilin Gol League, Inner Mongolia Autonomous Region, Ejina Banner and Alashan Zuoqi of Alashan League, Jinchuan Development Zone and Xincheng District of Hohhot City, Wuyuan County of Bayannur City, and Ejinhoro Banner of Ordos City.

Chengguan District, Lanzhou City, Gansu Province, Xiyuan Street, Qilihe District, Ganzhou District, Zhangye City, Maiji District and Qinzhou District of Tianshui City.

Huichuan District, Zunyi City, Guizhou Province.

Beiqijia Town, Dongxiaokou Town, Chengbei Street, Tiantongyuan South Street, Fengtai District, Beijing.

Jinfeng district, xingqing district, Xixia District, Yinchuan City, Ningxia Hui Autonomous Region, Zhongning County, zhongwei.

Xindu District, Xingtai City, Hebei Province, Lianchi District, Baoding City, Shenze County, qiaoxi district and Yuhua District, Shijiazhuang City.

Ping ‘an District, Haidong City, Qinghai Province, Chengxi District, Xining City.

Youxian County, Zhuzhou City, Hunan Province.

Ruili City and Longchuan County, Dehong Prefecture, Yunnan Province.

Fushun County, Zigong City, Sichuan Province.

Wulian County, Rizhao City, Shandong Province.

Aihui District, Heihe City, Heilongjiang Province, Xiangfang District and Pingfang District, Harbin City.

Lead Mountain County, Shangrao City, Jiangxi Province, Chaisang District, Jiujiang City.

implementthreeTiannei2Secondary (interval)24Hours) nucleic acid test, all negative, into the community management, health monitoring to leave the residence full.14God forbid.

Other areas of Alashan League in Inner Mongolia Autonomous Region, other areas of Xilin Gol League, other areas of Hohhot, other areas of Bayannaoer City and other areas of Ordos City.

Other areas in Lanzhou City, Gansu Province, other areas in Zhangye City, Jiayuguan City, Jiuquan City, Longnan City and Tianshui City.

Yanta District, beilin district and Baqiao District, Xi ‘an City, Shaanxi Province.

Other areas in Zunyi City, Guizhou Province.

Other areas in Changping District, Beijing, other areas in Fengtai District, Haidian District.

Other areas of Yinchuan City, Ningxia Hui Autonomous Region, other areas of zhongwei, wuzhong.

Other areas of Xingtai City, Hebei Province, other areas of Baoding City, ShijiazhuangOther areas of the city.

Other areas in Haidong City, Qinghai Province, and other areas in Xining City.

Changsha County, Yuhua District, Changsha City, Hunan Province, and other areas of Zhuzhou City.

Other areas in Dehong Prefecture, Yunnan Province.

Tianmen City, Hubei Province.

Other areas in Rizhao City, Shandong Province.

Other areas in Heihe City, Heilongjiang Province, and other areas in Harbin City.

Other areas in Shangrao City, Jiangxi Province, and other areas in Jiujiang City.

check48Negative report of hourly nucleic acid test.

Persons who have come (returned) to Sichuan with a history of living in provinces (autonomous regions and municipalities directly under the Central Government) reported by local COVID-19 cases and asymptomatic infected persons.

Summary of key trajectory information of some local cases within 14 days

scenic spot

From October 17th to 30th,Gexian Village Resort, Gexian Mountain Town, Qianshan County, Shangrao City, Jiangxi Province.

From October 30 to October 31,Shanghai Disneyland and Disney Town.

scheduled flight

October 18th:MU2474 (Wuhan-Lanzhou)

October 20:MU2399 (Lanzhou-Changsha)

train

October 18th:Z161 (Beijing West-Xingtai), C612 (Zhongchuan Airport-Lanzhou West), K9661 (Lanzhou West-Zhangye), G2261 (Yinchuan-Rizhao West), D754 (Lanzhou-Hadapu), Panda Special Train (Train Y472).

October 19:Z312 (Xining-Hohhot)

Since October 18th:Panda train returning to Sichuan from Ejina Banner or Longnan, Gansu Province

October 21st:K7031 (Harbin-Heihe)

October 24:K7034 (Heihe-Harbin)

From 16: 40 to 18: 50 on October 29:G2037 train (Shangrao Railway Station-Lushan Station)

October 29:G1382 (Shangrao-Shanghai), especially the personnel in cars 4, 5 and 6;

October 30:K287 (Shanghai-Nanchang)

Tips

Stay alert, take precautions, wash your hands frequently, avoid getting together and gathering less. If you have fever, cough and other unwell symptoms, please go to the fever clinic, sentinel clinic and Covid-19 nucleic acid testing institution nearby in time.

Check the nearest medical and health institution at any time.

Quick consultation and accurate appointment.

END

Source: Leshan Shizhong District Rong Media Center District health bureau Sichuan disease control

Editor in chief:Dani

Editor: Wang Zhuoran

Editor: Zhou Yuanli

Submission: 1254419267@qq.com

Statement:basisThe platform does not involve commercial use and does not charge any fees.The copyright belongs to the original author. If there is any infringement, please contact us.Delete.

@ Leshan citizen, you have a proposal of "Civilized Traffic and Green Travel", please check it!

Chuangwen is in action | Create a civilized city to praise you!